UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | |

| ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| Preliminary Proxy Statement | ||

| Confidential, | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material | ||

Annaly Capital Management, Inc.

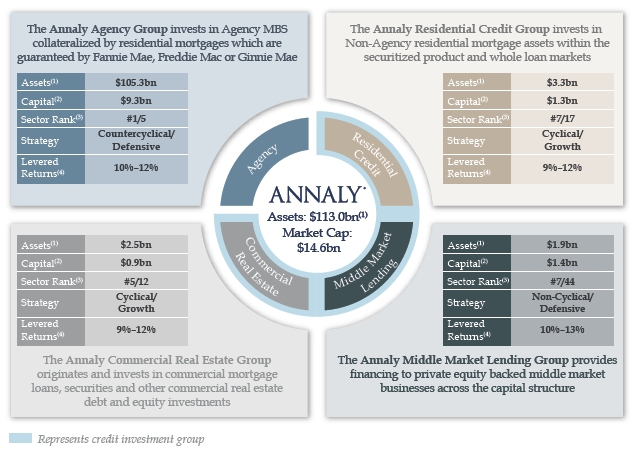

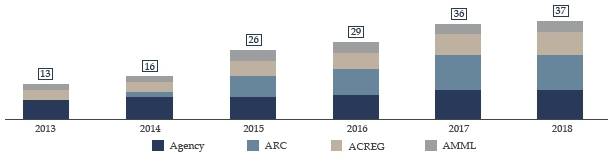

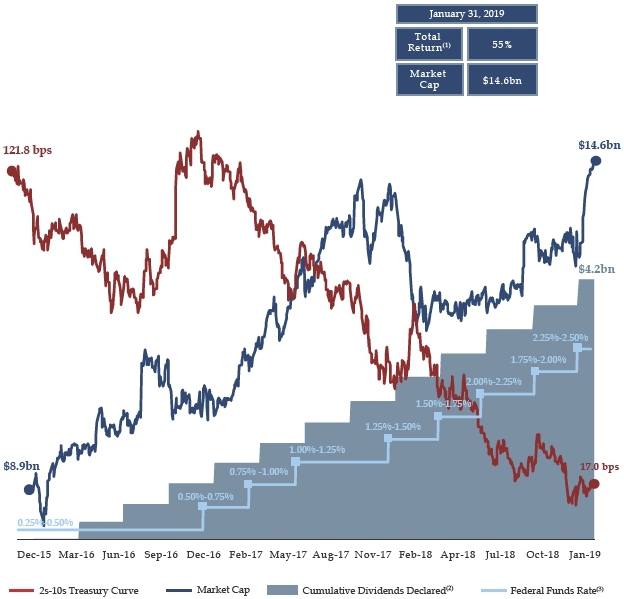

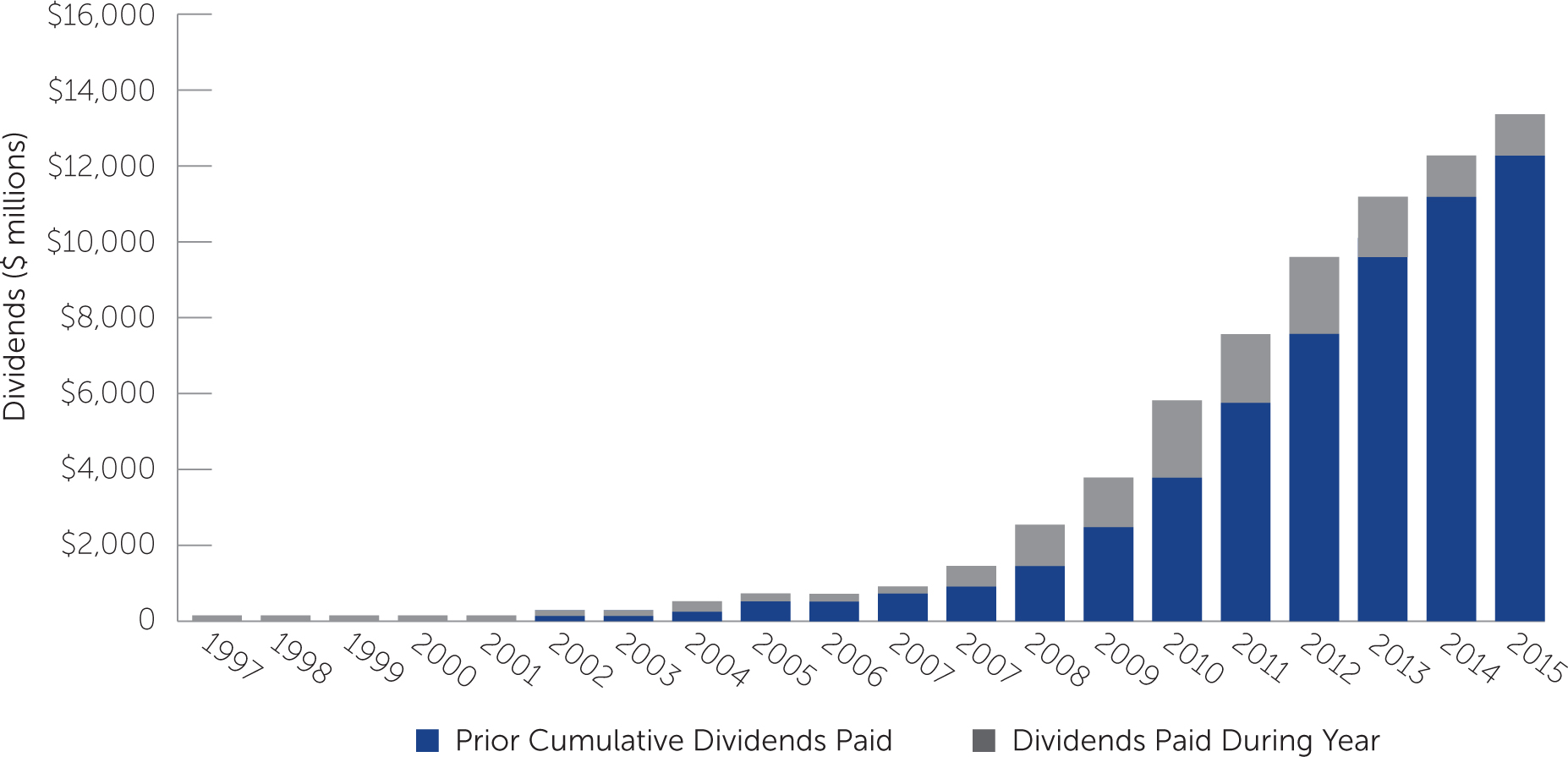

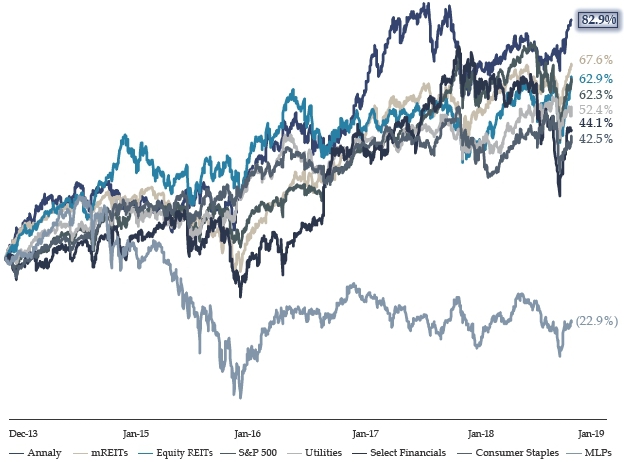

(Name of Registrant as Specified In Its Charter) Message from our Chairman, CEO and President Dear Fellow Shareholders, 2018 was a year of transformation for Annaly. We successfully delivered on many of the key corporate goals we communicated to you last year, and despite a difficult macro environment, reached a number of significant strategic milestones made possible by the institutionalization and diversification of Annaly over the past five years. The progress made in 2018 further establishes Annaly as a market and governance leader and positions the Company to continue executing upon the most integral components of our platform and strategy, which are outlined in the themes below. Operating & Investment Platform Diversified Shared Capital Model Financing, Capital & Liquidity Diversification in the ways we access capital and the broadening of our financing alternatives are equally important in driving our outperformance and capital efficiency. Since the beginning of 2016, we have increased our capital base by $6.5 billion, more than half of which was sourced from avenues besides common equity offerings, further illustrating our leadership in the capital markets.(2) We continue to enhance our capital efficiency through non-recourse, dedicated financing structures for each of our credit businesses – improving terms of existing arrangements, increasing financing capacity and establishing new counterparty relationships. Specifically, since the beginning of 2018, we have added $2.4 billion of additional borrowing capacity across our three credit businesses and expanded our financing diversification by establishing Annaly as a repeat issuer in the residential and commercial securitization markets.(3) Operational Efficiency Continuing to scale our differentiated operating platform has provided a foundation for growth, diversification and efficiency that is unmatched in the industry. Since 2014, we have made significant investments across our four businesses, adding expertise and depth to our investment teams and best-in-class infrastructure to support our strategies. Notably, we have grown our total number of IT professionals by over 40% during this time period. Our expanded in-house technology capabilities have led to the development of proprietary portfolio analytics, financial and capital allocation models, risk testing and accounting software, providing Annaly with distinct competitive advantages and cost savings. Growth Strategies & Performance Growth & Income We have demonstrated, and the market has clearly validated, that size and scale drive performance. 2018 marked another successful year for Annaly and the execution of our long-term growth strategy. We capitalized on a number of opportunities that continue to solidify Annaly’s brand as a market and governance leader. Since 2016, amidst a market backdrop with the Fed raising rates eight times and the yield curve flattening by Note: For footnoted information, please refer to “Message from our Chairman, CEO and Organically, we have continued to Risk-Adjusted Returns The diversification and size of Annaly’s lower-levered capital base and investment businesses, along with our prudent risk management processes, continue to drive outperformance of Annaly’s total return. Since 2014, our total shareholder return of 83% is 1.2x higher than mREITs, 1.3x higher than the S&P 500 and 2.3x higher than the Yield Sectors.(4)In addition to our absolute returns, our proprietary model is producing higher cash flow margins than most any other financial services company – our pre-tax margins of approximately 60% are 3x higher than the average for corporations in the Yield Sectors.(5) Corporate Responsibility and Governance Corporate Governance Our dedication to corporate responsibility and governance also sets us apart from the market – and undoubtedly is another contributor to Annaly’s historical outperformance. We believe that continually evaluating the framework of our corporate responsibility and governance practices ensures alignment and transparency, resulting in increased value to our shareholders over the long term. In order to more specifically frame our efforts and illustrate our industry leading commitment to governance, we recently published a comprehensive narrative on our website detailing our commitment to ESG, which others are now, of course, beginning to emulate. In 2018, we also announced two important governance enhancements: the decision to declassify our Board initiating annual election of all Directors, along with adopting an enhanced Board Refreshment Policy that contains both tenure and age limit provisions. Our commitment to Board refreshment is further demonstrated by the election of four new independent directors since the beginning of 2018, three of whom are women, which will bring the percentage of women on the Board to 45% following the 2019 Annual Meeting of Stockholders(6), which is nearly 2x higher than the average for the S&P 500. Human Capital Behind the achievements and successes highlighted in this letter, and in everything we do, is the deep and varied expertise of our most important asset – our people. Today we have over 170 talented professionals, the largest number in the Company’s history, who have supported our successful evolution from a mono-line Agency mortgage REIT to the Industry Innovator we are today.(7)We are very proud of how hard we work at the Company each day and how well we treat each other as partners, and in 2018 we recorded the highest level of employee satisfaction since we initiated our annual employee engagement survey in 2015.(8) We continue to expand our initiatives focused on advancing diversity throughout the Firm, which remains a key business priority. In 2018, 47% of new hires identified as racially diverse, increasing overall firm diversity to 32%, which is 60% higher than our industry based on Bureau of Labor Statistics data.(9)Additionally, nearly 40% of new hires in 2018, 40% of Managing Director promotions and 50% of additions to Annaly’s Operating Committee since 2015 have been women. Note: For footnoted information, please refer to “Message from our Chairman, CEO and President” in Endnotes section. Responsible Investments Finally, our dedication to ESG principles, as well as our deep investment capabilities, uniquely positions us to support the vitality of local communities and the economy. This past year, we As we look ahead, Finally, this year we are excited to once again virtually “host” investors from around the world at our Note: For footnoted information, please refer to “Message from our Chairman, CEO and President” in Endnotes section. To the Stockholders of Annaly Capital Management, Inc.: Your vote is very important. Please exercise your right to vote. To view the Proxy Statement and other materials about the Annual Meeting, go to www.annalyannualmeeting.com or www.proxyvote.com. All stockholders are cordially invited to attend the Annual Meeting, which will be conducted via a live webcast for a second consecutive year. The Company saw increased stockholder attendance and participation at its first virtual stockholder meeting in 2018 and is confident that this format will once again allow enhanced interaction with our global stockholder base. During the upcoming virtual meeting, you may ask questions and will be able to vote your shares electronically from your home or any remote location with Internet connectivity. You may also submit questions in advance of the Annual Meeting by visiting www.proxyvote.com. The Company will respond to as many inquiries at the Annual Meeting as time allows. An audio broadcast of the Annual Meeting will also be available to stockholders by telephone toll-free at 1-877-328-2502. If you plan to attend the Annual Meeting online or listen to the telephonic audio broadcast, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. Please note that listening to the audio broadcast will not be deemed to be attending the Annual Meeting, and you cannot ask questions or vote from such audio broadcast. The Annual Meeting will begin promptly at 9:00 a.m. (Eastern Time). Online check-in will begin at 8:30 a.m. (Eastern Time), and you should allow ample time for the online check-in procedures. By Order of the Board of Directors, Chief Corporate Officer, Chief Legal Officer and Secretary This summary contains highlights about the Company and the Annual Meeting. This summary does not contain all of the information that you should consider in advance of the Annual Meeting, and Stockholders are able to vote by Internet at Voting Stockholders may Internet Telephone Online Information After years of declining attendance at Annaly’s in-person annual meetings and marked growth of our international stockholder base over the same time period, the Company saw increased stockholder attendance and participation at its first virtual annual meeting in 2018. The Company is excited to once againembrace the virtual meeting format for the 2019 Annual Meeting. This environmentally-friendly approach also aligns with the Company’s broader sustainability goals and reduces costs for both the Company and its stockholders. The virtual meeting will be available to stockholders across the globe via any Internet-connected device and has been designed to provide the same rights to participate as you would have at an in-person meeting, including providing opportunities to make statements and ask questions. You are entitled to participate and vote at the Annual Meeting by visiting www.virtualshareholdermeeting.com/NLY2019. An audio broadcast of the Annual Meeting will also be available to stockholders by telephone toll-free at 1-877-328-2502. If you plan to attend the Annual Meeting online or listen to the telephonic audio broadcast, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. Stockholders can access Annaly’s interactive pre-meeting forum, where you can submit questions in advance of the Annual Meeting and view copies of the Company’s proxy materials, by visiting www.proxyvote.com. If you wish to view the webcast at a location provided by the Company, the Company’s Maryland counsel, Venable LLP, will air the webcast at its offices located at 750 E. Pratt Street, Suite 900, Baltimore, MD 21202. Please note that no members of management or the Board will be in attendance at this location. If you wish to view the Annual Meeting via webcast at Venable LLP’s office, please complete the Reservation Request Form found at the end of this Proxy Statement. Proxy Summary NLY 1997 $14.6 billion The Company has $4.2 billion 37 50% $906 million $900 million 44% Note: For footnoted information, please refer to “Annaly at a Glance & Recent Operating Achievements ” in Endnotes section. Annaly's Diversified Shared Capital Model Diversification is a The Company has 37 investment options across its four investment groups, which is nearly three times more than in 2013 and up from 26 options at the end of 2015. While managing investment decisions, the Company combines a robust capital allocation process with careful risk management. This process enables Annaly to take advantage of market fluctuations and inefficiencies and rotate into credit markets when dislocations occur and Note: For footnoted information, please refer to “Annaly’s Diversified Shared Capital Model” in Endnotes section. Proxy Summary Growth and Income $5.7 billion $4.2 billion 55% Since January 2016, Annaly has grown its market cap by $5.7 billion, or 64%, and declared over $4.2 billion in cumulative dividends to stockholders amidst a challenging market backdrop, where the Federal Reserve has raised rates 8 times and the Treasury curve has flattened by 86%. Note: For footnoted information, please refer to “Growth and Income” in Endnotes section. Proxy Summary Delivering Significant Value Since 2014 (the first full year Note: Proxy Summary Stockholder Outreach and ~275 ~110 Over 94% Annaly’s stockholder engagement efforts generated significant feedback for both the Board and management and have resulted in a number of enhancements to corporate governance and compensation practices and Proxy Summary Stockholder Engagement Review Classified Focus on Board Enhance Board Deepen Corporate Note: For footnoted information, please refer to “Stockholder Engagement” in Endnotes section. Proxy Summary Corporate Responsibility As responsible stewards of capital, Annaly takes into account ESG factors that contribute to our ability to drive positive impacts and deliver attractive risk-adjusted returns over the long term. Annaly’s Corporate Responsibility efforts were institutionalized by the establishment of a dedicated Corporate Responsibility team in 2018, which is led by Tanya Rakpraja as Annaly’s Head of Corporate Responsibility and Government Relations. The Corporate Responsibility team collaborates across business areas to develop initiatives, monitor progress and manage reporting, and provides routine updates to the Corporate Responsibility Committee(1) of the Board (and, as appropriate, to the full Board). The Company provides extensive disclosure on its ESG efforts on the “Corporate Responsibility” section of Annaly’s corporate website at www.annaly.com/corporate-responsibility. The Manager and The Management Agreement 0.75% 29% $300 million In 2019, the Manager reduced Annaly’s management fee is Approximate compensation All of Proxy Summary The Manager’s Executive Compensation Program 90.5% 9.5% 16.8% of NEO compensation was variable and paid in the form of performance-based incentive bonuses of NEO compensation was paid in the form of fixed base salaries of aggregate management fees and expense reimbursements paid to the Manager were allocated by the Manager as NEO compensation Although Annaly neither employs nor compensates the NEOs, the Company is committed to providing its stockholders with information about the Manager’s executive compensation program in order to enable an informed Say-on-Pay vote. The Manager’s Executive Compensation Philosophy and Process The key principle of the Manager’s compensation philosophy for all employees, including the NEOs, is to pay for performance. The Manager’s NEO compensation planning process incorporates key areas of evaluation including: external market data, internal benchmarking, and quantitative and qualitative assessments of Company, group and individual performance. Individuals are evaluated based on mid-year and year-end manager reviews and the utilization of a 9-box talent review model, which assesses individual performance and potential. In establishing and reviewing individual NEO compensation packages, the Manager also considers the nature and scope of each NEO’s role and responsibilities, retention considerations and feedback from stakeholders. Overview of the Manager’s 2018 Executive Compensation Program For additional information about the Manager, the management agreement and executive compensation, see “Certain Relationships and Related Party Transactions,” “Management Structure,” “Compensation Paid by the Manager to the Named Executive Officers” and “Compensation Discussion and Analysis.” Note: For footnoted information, please refer to “Overview of Manager’s 2018 Executive Compensation Program” in Endnotes section. Proxy Summary Board Composition, Structure And Refreshment 12 or 73 2021 45% Independent Directors may All Directors will stand for of Annaly’s Continuing The NCG Committee seeks to achieve a balance of knowledge, experience and capability on the Board. Newer Directors offer fresh ideas and perspectives, while deeply experienced Directors bring extensive knowledge of the Company’s complex operations. The table below summarizes key qualifications, skills, and attributes most relevant to the Continuing Directors’(1)service on the Board. For additional information about individual Director’s qualifications and experience, please see the Director biographies beginning on page 15. Skill / Experience Summary of Continuing Directors(1) The Board annually evaluates its overall composition and rigorously evaluates individual Directors to ensure a continued match of their skill sets and projected tenure against the needs of the Company. As a result of this process, the Board elected new Independent Directors, Kathy Hopinkah Hannan and Thomas Hamilton, effective February 13, 2019 and March 6, 2019, respectively. In 2018, the Board also underwent a comprehensive third-party facilitated self-evaluation, which included assessments of the full Board, each Board committee and individual Directors. Focus areas of this evaluation included Board and Committee skills, structure, dynamics, processes, leadership and refreshment. Based on the results of its self-evaluation, the Board determined to conduct a follow-up review to further analyze considerations related to Board refreshment, including Director term and tenure. This review, which benefitted from significant stockholder feedback, ultimately led to the adoption of a Board refreshment policy requiring that Independent Directors may not stand for re-election following the earlier of their 12thanniversary of Board service or their 73rdbirthday. In addition, this analysis informed the Board’s unanimous approval and adoption of a bylaw amendment to declassify the Board over a three-year period beginning with the 2019 Annual Meeting, with all Directors standing for annual election commencing with the 2021 Annual Meeting. Note: For footnoted information, please refer to “Board Composition, Structure and Refreshment” in Endnotes section. 2015 Note: For footnoted information, please refer to “Corporate Governance at Annaly” in Endnotes section. Corporate Governance at Annaly Consistent with its commitment to strong corporate governance practices, the Board is in the process of Lead Independent Director. For more details, see page 26. Corporate Governance at Annaly Director Nominees Mr. Keyes serves as Annaly’s Chairman, Chief Executive Officer and President. Mr. Keyes has served as Chairman since January 2018, Chief Executive Officer Director Qualification Highlights Director since Committees Corporate Governance at Annaly Director Qualification Highlights Director since Committees Corporate Governance at Annaly Directors Whose Current Terms Expire in 2020 Ms. Bovich has over 30 years of investment management experience lastly serving as a Managing Director of Morgan Stanley Investment Management from 1993-2010. Since 2011, Ms. Bovich has been a trustee of The Bradley Trusts. Ms. Bovich has also served as a board member of The Dreyfus Family of Funds since 2012, and serves as a board member of a number of registered investment companies within the fund complex. These funds represent a broad scope of investment strategies including equities Director Qualification Highlights Director since Committees Corporate Governance at Annaly Lead Independent Mr. Green served as a special advisor to Rockefeller Group International, Inc., a wholly owned subsidiary of Mitsubishi Estate Company, Ltd., operating under the brand of Director Qualification Highlights Mr. Schaefer has over 40 years of financial services experience including serving as a member of the management committee of Morgan Stanley from 1998 through Director Qualification Highlights Corporate Governance at Annaly Ms. Denahan co-founded Annaly in 1996 and has served as a Director since that time. Until December 2017, Ms. Denahan served as Chairman of the Board Director Qualification Highlights Mr. Haylon has served as Managing Director and Head of Director Qualification Highlights Director since Mr. Segalas Director Qualification Highlights Corporate Governance at Annaly The Board’s Role and Responsibilities The Company is committed to maintaining a strong ethical culture and robust governance practices that benefit the long-term interests of stockholders, which include: Note: For footnoted information, please refer to “The Board’s Role and Responsibilities” in Endnotes section. Corporate Governance at Annaly The Director Criteria and Qualifications The NCG Committee seeks to achieve a balance of knowledge, experience and capability on the Board and considers a wide range of factors when assessing potential Director nominees, including a candidate’s background, skills, expertise, diversity, accessibility and availability to serve effectively on the Board. All candidates should (i) possess the highest personal and professional ethics, integrity and values, exercise good business judgment and be committed to representing the long-term interests of the Company and its stockholders, and (ii) have an inquisitive and objective perspective, practical wisdom and mature judgment. It is expected that all Directors will Consideration of Board Diversity Stockholder Recommendation of Director Candidates Stockholders who wish the NCG Committee to consider their recommendations for Director candidates should submit their recommendations in writing to Table of Contents Board Effectiveness, Self-Evaluations and Refreshment The Company’s comprehensive Board and Committee refreshment and succession planning process is designed to ensure that the Board and each Committee is comprised of highly qualified Directors, with the independence, diversity, skills and perspectives to provide strong and effective oversight. The Board, led by the NCG Committee, annually evaluates the composition of the Board and each Committee, and rigorously evaluates individual Directors to ensure a continued match of their skill sets and tenure against the needs of the Company. As a result of this process, the Board elected new Independent Directors Kathy Hopinkah Hannan and Thomas Hamilton, effective February 13, 2019 and March 6, 2019, respectively. Dr. Hannan and Mr. Hamilton were identified as potential Director nominees by two separate members of senior management, and were elected to the Board after an extensive and careful search was conducted, and after numerous other candidates proposed by Directors, members of management and a professional search firm were considered. The NCG Committee is responsible for overseeing an annual self-evaluation process for the Board. The self-evaluation process seeks to identify specific areas, if any, that need improvement or strengthening in order to increase the effectiveness of the Board as a whole and its members and committees. In early 2018, the Board adopted an enhanced Board self-evaluation process that includes annual assessments of the full Board, each Board committee and individual Directors, along with periodic use of an external facilitator. In the summer of 2018, an outside governance expert facilitated this comprehensive self-evaluation. Focus areas included Board and Committee skills, structure, dynamics, processes, fulfillment of responsibilities, leadership and refreshment. Based on the results of its self-evaluation, the Board determined to conduct a follow-up review to further analyze considerations related to Board refreshment, including Director term and tenure. This review, which benefitted from significant stockholder feedback, ultimately led to the adoption of a Board refreshment policy requiring that Independent Directors may not stand for re-election following the earlier of their 12thanniversary of Board service or their 73rdbirthday. In addition, this analysis informed the Board’s unanimous approval and adoption of a bylaw amendment to declassify the Board over a three-year period beginning with the 2019 Annual Meeting, with all Directors standing for annual election commencing with the 2021 Annual Meeting. Board Commitment and Over-Boarding Policy In order to provide sufficient time for informed participation in their Board responsibilities: All Directors are Note: For footnoted information, please refer to “Board Effectiveness, Self-Evaluations and Refreshment” in Endnotes section. Corporate Governance at Annaly Risk management begins with the Board, through review and oversight of the Company’s risk management framework, and continues with executive management, through ongoing formulation of risk management practices and related execution in managing risk. The Board exercises its oversight of risk management primarily through its Risk Committee and Audit Committee. At least annually, the full Board reviews with management the Company’s risk management program, which identifies and quantifies a broad spectrum of enterprise-wide risks, including cyber and technology-related risks, and related action plans Assists the Board in its oversight of the Company’s risk governance structure, risk management and risk assessment guidelines and policies, and risk appetite, including risk appetite levels and capital adequacy and limits Assists the Board in its oversight of the quality and integrity MANAGEMENT Responsible for day-to-day risk assessment and risk management. A series of management committees have decision-making responsibilities for risk assessment and risk management CEO Performance Reviews and Management Succession Planning The Lead Independent Director and the Chair of the Compensation Committee jointly coordinate and lead the Board’s annual performance evaluation of the CEO, which reflects input from all non-executive Directors. The Board Corporate Governance at Annaly Stockholders and other persons interested in communicating with an individual Director (including the Lead Independent Director), the Independent Directors as a group, any committee of the Board or the Board as a whole, may do so by submitting such communication to: Annaly Capital Management, Inc. The Legal Department reviews all communications to the Directors and forwards those communications related to the duties and responsibilities of the Approval of Related Party Transactions The Board recognizes the fact that transactions with related persons present a heightened risk of conflicts of interests and/or improper valuation (or the perception thereof). The Board has adopted a written policy on transactions with related persons that is in conformity with NYSE listing standards. Under this policy any related person transaction, and any material amendment or modification to a related person transaction, must be reviewed and approved or ratified by any standing or ad hoc committee of the Board composed solely of Independent Directors who are disinterested or by the disinterested members of the full Board. In connection with the review and approval or ratification of a related person transaction, management must: In addition, the related person transaction policy provides that the committee or disinterested Directors, as applicable, in connection with any approval or ratification of a related person transaction involving a non-employee Director or Director nominee, should consider whether such transaction would compromise the Director or Director nominee’s status as an “independent,” or “non-employee” Director, as applicable, under the rules and regulations of the SEC, the NYSE and the Code of Business Conduct and Ethics. Corporate Governance at Annaly Management Agreement The Management If the Company elects to terminate the Management Agreement, The Management Agreement provides that during its term and, in the event of termination of the Management Agreement by The Manager Note: For footnoted information, please refer to “Management Agreement” in Endnotes section. CEO Board Structure and Processes Executive Sessions of Independent Directors Director Orientation and Continuing Education The Board believes that Director orientation and board education programs, along with research on governance trends and Code of Business Conduct and Ethics Corporate Governance Guidelines Other Governance Policies Annaly’s Directors, executive officers and employees are also subject to the Company’s other governance policies, including a Foreign Corrupt Practices Act and Anti-Bribery Compliance Policy, an Insider Trading Policy, and a Regulation FD Policy. Where You Can Find The Code of Conduct, Corporate Governance Guidelines, Compensation Committee Charter, Audit Committee Charter, NCG Committee Charter, Corporate Responsibility Committee Charter and Risk Committee Charter are available on Board Structure and Processes The Board created the new Member Chairperson E Financial Expert Committee Membership Determinations Note: For footnoted information, please refer to “Board Committees” in Board Structure and Processes For more information on the Audit Committee’s responsibilities and activities, Compensation Committee Number of Meetings Each member of the Compensation Committee is independent of the Company and management under the listing standards of the NYSE. For more information on the Compensation Committee’s responsibilities and activities, Note: For footnoted information, please refer to “Audit Committee & Compensation Committee” in Endnotes section. Board Structure and Processes NCG Committee Number of Meetings in Each member of the NCG Committee is independent of the Company and management under the applicable listing standards of the NYSE. For more information on the NCG Committee’s responsibilities and activities, Corporate Responsibility Committee(3) Number of Meetings Risk Committee Number of Meetings Note: For footnoted information, please refer to “NCG Committee, Corporate Responsibility Committee Board Structure and Processes During The annual compensation elements paid to Each DSU is equivalent in value to one share of Director Stock Ownership Guideline Board Structure and Processes Role of the Independent Compensation Consultant During Director Compensation The table below summarizes the compensation paid by The following table sets forth information with respect to the aggregate The following table sets forth certain information with respect to Biographical information on Mr. Keyes Glenn A. Votekhas served as Chief Financial Officer of Annaly since August 2013. Mr. Votek also served as Chief Financial Officer of Fixed Income Discount Advisory Company, Timothy P. Coffeyhas served as Chief Credit Officer of Annaly since January 2016. Mr. Coffey served as Annaly’s Head of Middle Market Lending from 2010 until January 2016. Mr. Coffey has over 20 years of experience in leveraged finance and has held a variety of origination, execution, structuring and distribution positions. Prior to joining Annaly in 2010, Mr. Coffey served as Managing Director and Head of Debt Capital Markets in the Leverage Finance Group at Bank of Ireland. Prior to that, Mr. Coffey held positions at Scotia Capital, the holding company of Saul Steinberg’s Reliance Group Holdings, and SC Johnson International. Mr. Coffey received his B.A. in Finance from Marquette University. Anthony C. Greenhas served as Chief Corporate Officer of Annaly since January 2019 and Chief Legal Officer and Secretary Stock Purchases by Executive Officers Since 2011 Since 2011, From the inception of the Company's management externalization transaction (the “Externalization”) in 2013 through March 2019, the Company paid the Manager a flat monthly management fee for its management services equal to 1/12thof 1.05% of Stockholders’ Equity(2). In March 2019, the Manager and the Company amended the Management Agreement for the sole purpose of reducing the monthly management fee on Incremental Stockholders’ Equity(3). Pursuant to this amendment, which recognizes the efficiencies that have been gained with scale, the Company pays the Manager a monthly management fee equal to 1/12thof the sum of: (i) 1.05% of Base Stockholders’ Equity(4), and (ii) 0.75% of Incremental Stockholders’ Equity(3). In addition to the management fee, the Company continues to reimburse the Manager for certain legal, tax, accounting and other support and advisory services provided by employees of the Manager to the Company as permitted pursuant to the terms of the Management Agreement. Note: For footnoted information, please refer to “Overview, Recent Changes & Management Agreement Management Structure Structure and Amount of the Management Fee The Compensation Committee annually reviews both the structure of the management fee as well as the amount of such fee to determine whether they incentivize the Moreover, the Compensation Committee believes that a management fee that is based upon The Compensation Committee also believes that the structure of the management fee is more favorable to In addition to the management fee, in August 2018, following the unanimous approval of the Independent Directors, the Company began reimbursing the Manager for certain legal, tax, accounting and other support and advisory services provided by employees of the Manager to the Company. These reimbursements (which totaled $9.2 million for 2018) are permitted pursuant to the terms of the Management Agreement provided the related costs are no greater than those that would be payable to comparable third party providers. Clawback for the Management Fee Pursuant to the Management Agreement, the Company is entitled to receive reimbursement from the Manager if the Board determines that a computation error (regardless of the reason for or amount of such error) resulted in the overpayment of a management fee to the Manager. Continued Cost Savings Related to the Externalization Note: For footnoted information, please refer to “Structure and Amount of the Management Fee & Management Structure Annual Review of Manager Performance and Management Fee Considerations The Compensation Committee annually reviews The Compensation Committee also reviews In its review of these operating expense ratios, the Compensation Committee noted that the Company has outperformed both Note: For footnoted information, please refer to “Annual Review of Manager Performance and The NEOs for 2018 are: As discussed above in “Management Structure,” the Company is externally managed by the Manager and pays the Manager a management fee, the purpose of which is not to provide compensation to the NEOs, but rather to compensate the Manager for the services it provides for the day-to-day management of the Company. The proceeds of the management fee are used by the Manager in part to pay compensation to the NEOs other than Mr. Keyes (who does not receive any compensation for serving as the Company’s Chairman, CEO and President, but has an interest in the management fee as an indirect equityholder of the Manager). As an externally-managed issuer, the Company does not determine the compensation payable by the Manager to the NEOs, does not al-locate any specific portion of the management fee it pays to the compensation of the NEOs, and does not reimburse the Manager for the cost of such compensation. Aside from a severance agreement directly between the Company and Mr. Keyes and the ability of the Compensation Committee to grant plan-based equity awards to the NEOs (which it has not exercised since the Externalization), the Manager makes all decisions relating to compensation it pays to the NEOs based on the factors, including individual and Company performance, it determines to be appropriate and subject to any employment agreements entered into between the Manager and individual NEOs. The Manager’s Executive Compensation Program In order to enable the Company’s stockholders to make an informed Say-on-Pay vote, the Manager has provided the following information about the compensation it paid to the NEOs for 2018: Summary of 2018 NEO Compensation Note: For footnoted information, please refer to “Summary of 2018 NEO Compensation” in Endnotes section. Compensation Paid by the Manager to the Named Executive Officers NEO Compensation Philosophy and Process Individuals are evaluated assesses based on mid-year and year-end manager reviews and the utilization of a 9-box talent review model, which assesses individual performance and potential. In establishing and reviewing individual NEO compensation packages, the Manager also considers the nature and scope of each NEO’s role and responsibilities, retention considerations and feedback from stakeholders. The Company utilizes a third party compensation consultant to advise on external benchmarking and other compensation practices (as further described below under “Role of the Manager’s Compensation Consultants” and “Market Compensation Data”). NEO Compensation Practices The Manager’s pay-for-performance philosophy is reflected in the Manager’s compensation practices: Majority of compensation is “at risk” – variable performance-based compensation comprises 90.5% of the NEOs’ total compensation Multiple performance metrics – diversified mix of rigorous Company performance metrics, including core return on equity, core return on assets and operating expenses as a percentage of average equity and as a percentage of average assets, along with group and individual performance objectives Annual assessment of NEO compensation practices against peer companies and best practices External legal review Third-party compensation consultant Regular stockholder feedback through robust outreach program No guaranteed salary increases No targeting of specific percentiles versus peers in setting compensation levels No incentive or additional performance awards for growing assets under management or for exceeding returnbenchmarks No excessive perquisites No tax gross-ups Compensation Paid by the Manager to the Named Executive Officers Components of the NEOs’ Compensation The Manager’s executive compensation program includes both a base salary and a performance-based incentive bonus. Although the Compensation Committee has discretion to grant equity awards of Company common stock to the NEOs (which it has not exercised since the Externalization), the management fee the Company pays to the Manager is paid entirely in cash and therefore the Manager has no independent ability to provide awards of Company stock as part of the NEOs’ compensation. To address this limitation in the Manager’s executive compensation program, the Manager has structured the NEOs’ performance-based incentive bonuses with a mix of both rigorous Company performance metrics and group and individual performance objectives, which aligns the interests of the NEOs with the interests of the Company’s stockholders. This alignment is strengthened by the Company’s stock ownership guidelines, pursuant to which the NEOs purchase shares of the Company’s common stock in the open market (as further described under “Stock Ownership Guidelines/Commitments”). The table below describes the objectives supported by each of the Manager’s primary compensation elements, along with an overview of the key design features of each element. Base Salary Performance-Based NEO Pay Mix The Manager’s executive compensation program is designed so that the majority of compensation is performance-based and “at-risk” to promote alignment of the NEOs’ interests with those of stockholders. In determining payout of the NEOs’ performance-based incentive bonuses (which represents the variable portion of their compensation packages), the Manager considered achievement of both rigorous performance metrics, including core return on equity, core return on assets and operating expenses as a percentage of average equity and as a percentage of average assets, along with group and individual performance objectives. During 2018, Messrs. Votek, Finkelstein, Coffey, and Green received aggregate performance-based incentive bonuses of $28.7 million from the Manager. The base salaries for the NEOs (which represent the fixed portion of their compensation packages) are reviewed annually and may be increased or decreased as the Manager deems appropriate. During 2018, Messrs. Votek, Finkelstein, Coffey, and Green received aggregate salaries of $3.0 million from the Manager. On an aggregated basis, Messrs. Votek, Finkelstein, Coffey and Green received 9.5% of their total compensation in the form of base salaries and the remaining 90.5% in the form of performance-based incentive bonuses. Compensation Paid by the Manager to the Named Executive Officers Role of the Manager’s Compensation Consultant During 2018, the Manager retained a third-party compensation consultant for advice and perspectives regarding market trends that may impact decisions about the Manager’s executive compensation program and practices. Company Market Data The Manager considers compensation data and practices of a group of peer companies (the “Peer Group”), as well as current market trends and practices generally, in developing appropriate compensation packages for the NEOs. Compensation Peer Group The Board is committed to corporate governance best practices and recognizes the significant interest of stockholders in executive compensation matters. As described in detail under the headings The NEOs are eligible to receive equity awards pursuant to The Board unanimously recommends that the stockholders vote in favor of the following resolution: “RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and related narrative discussion, is hereby APPROVED.” While this vote is advisory and Executive Compensation Compensation Discussion and Analysis As discussed above, the Manager pays all of the compensation, including benefits, to the NEOs. As a private company not subject to the disclosure requirements of the SEC, the Manager has sole discretion to determine the compensation it pays to its employees, including the NEOs. The Manager makes all compensation determinations for the NEOs without any direction by the Board and without reference to any specific policies or programs under the oversight of the Board or the Compensation Committee. The Manager compensates the NEOs for a variety of services performed for the benefit of the Manager. Thus, the compensation paid by the Manager to its employees who are serving as the Company’s NEOs is not considered to be part of the Company’s executive compensation program. Pursuant to the terms of the Management Agreement, the Company pays the Manager a monthly management fee for its management services equal to 1/12thof the sum of: (i) 1.05% of Base Stockholders’ Equity(1), and (ii) 0.75% of Incremental Stockholders’ Equity(2). In addition to the management fee, the Company reimburses the Manager for the cost of certain legal, tax, accounting and other support and advisory services provided by employees of the Manager to the Company. During the year ended December 31, 2018, the Company incurred $179.8 million in management fees and $9.2 million in permitted reimbursement payments under the Management Agreement. None of the reimbursement payments were attributable to compensation of the Company’s NEOs. The proceeds of the management fee are used in part to pay compensation to the NEOs other than Mr. Keyes (who does not receive any compensation for serving as the Company’s Chairman, CEO and President, but has an interest in the management fee as an indirect equityholder of the Manager). The Company does not determine the compensation that the Manager pays to the NEOs, the Company does not allocate any specific portion of the management fee that the Company pays to the compensation of the NEOs, and the Company does not reimburse the Manager for the cost of such compensation. Accordingly, the Company did not pay any cash compensation to the NEOs, nor did the Company grant them any plan-based awards, for 2018. The Company does not provide the NEOs with pension benefits, perquisites or other personal benefits. As a result, no compensation is includable in the Summary Compensation Table. The Company is not party to any employment agreements entered into between the Manager and individual NEOs. However, the Company is party to the CEO Severance Agreement with Mr. Keyes, which provides for cash severance to be paid by the Company to Mr. Keyes in certain termination events. For more information, see “CEO Severance Agreement” and “Potential Payments upon Termination or Change in Control” below. No “single-trigger” severance amounts are payable to Mr. Keyes solely upon a change in control of the Company. The Company believes that providing appropriate severance benefits to Mr. Keyes upon certain termination events helps the Company retain Mr. Keyes’ services as its CEO. The CEO Severance Agreement also allows the Company to protect its interests through noncompetition provisions that continue to apply following Mr. Keyes’ termination as CEO of the Company. In connection with its review and recommendation of the CEO Severance Agreement, a special committee of the Board comprised of four independent Directors considered the executive compensation arrangements of its compensation peer group. Consideration of “Say-on-Pay” Voting Results At the Company’s 2018 Annual Meeting, over 94% of the votes cast supported the Company’s Say-on-Pay vote. Upon consideration of the high percentage of votes cast in support of the Say-on-Pay vote, along with additional feedback from engagement with stockholders, the Compensation Committee determined it was appropriate to continue providing detailed quantitative information about the Manager’s executive compensation program in the Company’s proxy materials. For additional details, please see “Compensation Paid by the Manager to the Named Executive Officers” above. The Company and the Board will continue to consider the outcome of future Say-on-Pay votes, as well as stockholder feedback received throughout the year, and invite stockholders to express their views to the Independent Directors as described under “Communications with the Board.” Note: For footnoted information, please refer to “Compensation Discussion and Analysis” in Endnotes section. Executive Compensation Executive Compensation Policies Stock Ownership Guidelines/Commitments Stock Holding Period The Manager’s employees (including the NEOs) are required to hold for a period of four years the net after-tax shares of Company stock they receive through stock option exercises or vesting of equity incentive awards. Prohibition on Hedging Company Securities The Company has a policy prohibiting the Manager’s employees (including the NEOs), employees of the Company and its subsidiaries, and members of the Board from engaging in any hedging transactions with respect to Company securities held by them. Such prohibited transactions include the purchase of any financial instrument (including forward contracts and zero cost collars) designed to hedge or offset any decrease in the market value of Company securities. Prohibition on Pledging Company Securities The Company has a policy prohibiting the Manager’s employees (including the NEOs), employees of the Company and its subsidiaries, and members of the Board from holding Company securities in a margin account or pledging Company securities as collateral for a loan. Risks Related to Compensation Policies and Practices As discussed above in “Management Structure,” the Compensation Committee is not entitled to approve compensation decisions made by the Manager and the Manager does not consult with the Compensation Committee prior to making any such decisions. Therefore, the Compensation Committee has no compensation policies or practices applicable to, or decision-making role regarding, the manner in which the Manager uses the management fee to compensate the NEOs. However, in connection with the Compensation Committee’s administration of the Company’s equity incentive plan and oversight of the CEO Severance Agreement, the Compensation Committee conducts an annual risk assessment of the Company’s applicable compensation policies and practices. In 2018, the Compensation Committee determined that these compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. Report of the Compensation Committee The Compensation Committee of the Company has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Note: For footnoted information, please refer to “Stock Ownership Guidelines/Commitments” in Endnotes section. Executive Compensation Executive Compensation Tables and Related Narrative Summary Compensation Table The Company did not pay any compensation to the NEOs, and did not reimburse the Manager for any compensation paid to the NEOs, with respect to the years ended December 31, 2018, December 31, 2017 or December 31, 2016. The Company did not grant the NEOs any plan based awards in 2018. Outstanding Equity Awards at Fiscal Year-End None of the NEOs had outstanding equity awards at December 31, 2018. Options Exercised and Stock Vested The Company does not provide the NEOs with any benefits pursuant to defined benefit plans and nonqualified deferred compensation plans. CEO Severance Agreement On August 1, 2018, the Company and Mr. Keyes entered into the CEO Severance Agreement. The term of the CEO Severance Agreement continues through July 31, 2020, and will automatically renew for successive one-year terms unless either party gives written notice (a “Notice of Non-Renewal”) to the other of its intention not to renew at least 180 days prior to the expiration of the then-current term. Upon (i) the removal of Mr. Keyes as the Company’s Chief Executive Officer without “cause” (as defined in the CEO Severance Agreement), (ii) the resignation of Mr. Keyes with “good reason” (as defined in the CEO Severance Agreement) or (iii) the expiration of the then-current term following a Notice of Non-Renewal provided by the Company (each, a “Severance Event”), the Company shall pay Mr. Keyes a cash payment equal to $30 million (the “Severance Payment”). The Severance Payment shall be payable in 12 equal monthly installments after Mr. Keyes’ separation from service upon or following a Severance Event (the “Severance Period”); provided that if such separation from service occurs within two years immediately following a “change of control” (as defined in the CEO Severance Agreement), the Severance Payment shall be made in a single lump sum. The payment of the Severance Payment shall be subject to the execution of a waiver and release of claims against the Company and its subsidiaries and affiliates and on Mr. Keyes’ continued compliance with applicable noncompetition provisions. For additional information about the CEO Severance Agreement, see “Compensation Discussion and Analysis.” Potential Payments upon Termination or Change in Control The following table sets forth quantitative information with respect to potential payments to Mr. Keyes or his beneficiaries upon various termination events described above, assuming termination on December 31, 2018. Other than Mr. Keyes, the Company has no responsibility to provide any payments or benefits to any NEO in connection with a termination of service or change in control. Payments are subject to the execution of a waiver and release of claims and compliance with applicable noncompetition provisions. Executive Compensation Compensation Committee Interlocks and Insider Participation The Manager is responsible for managing the Company’s affairs pursuant to This information is being provided for compliance purposes. Neither the Compensation Committee nor the Manager used the pay ratio measure in making any Executive Compensation As of March 25, 2019, we had 1,442,971,679 shares of Our charter currently allows us to issue up to a combined total of 2,000,000,000 shares of capital stock, par value $0.01 per share. The proposed amendment of our charter raises the total number of authorized shares of capital stock we are permitted to issue from 2,000,000,000 shares to 3,000,000,000 shares. Although our charter permits our Board to classify and reclassify any unissued shares of capital stock by setting or changing in any one or more respects the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends or other distributions, qualifications or terms or conditions of The proposed amendment to our charter deletes the current ARTICLE VI(A) of our charter and replaces it with the following: “ARTICLE VI The Board declared advisable, and unanimously recommends a voteFORthe approval of an amendment to our charter to increase the number of authorized shares to 3,000,000,000 shares. Executive Compensation To retain the The approval of the proposed amendment to the Company’s charter requires the affirmative vote of the holders of a majority of the total number of issued and outstanding shares of our The Audit Committee operates pursuant to a charter which it reviews annually, and a brief description of the Audit Committee’s primary responsibilities is included under the heading “Board Committees – Audit Committee” in this Proxy Statement. Under the Audit Committee’s charter, management is responsible for the preparation of the Company’s financial statements and the independent registered public accounting firm is responsible for auditing those financial statements and expressing an opinion as to their conformity with U.S. generally accepted accounting principles. In addition, the independent registered public accounting firm is responsible for auditing and expressing an opinion on the Company’s internal controls over financial reporting. The Audit Committee has discussed with Ernst & Young the matters required to be discussed by In reliance on these reviews and discussions, and the report of the independent registered public accounting firm, the Audit Committee has recommended to Audit Committee Matters Relationship with Independent Registered Public Accounting Firm The aggregate fees billed for The Audit Committee has also adopted policies and procedures for pre-approving all non-audit work performed by accounting consultations on matters addressed during the audit or interim reviews The Audit Committee determined that the provision by EY of these non-audit services is compatible with EY maintaining its independence. The Company understands the need for Security Ownership of Certain Beneficial Owners and Management The following table sets forth certain information as of March Knowledge of the beneficial ownership of Amount and Stock Ownership Information Includes: (i) 10,000 shares owned by Includes: (i) 3,000 shares owned by the Hercules Segalas Irrevocable Trust, (ii) 900 shares owned by Mr. Segalas’ daughters, and (iii) 2,100 shares owned by the Katherine Lacy Segalas Devlin Irrevocable Trust. Mr. Segalas disclaims beneficial ownership of these 6,000 shares. BlackRock, Inc., 55 East 52nd Street, New York, NY The Vanguard Group, Inc., 100 Vanguard Blvd., Malvern, PA 19355, as a parent holding company or control person of certain named funds (“Vanguard”), filed a Schedule 13G/A on February Section 16(a) Beneficial Ownership Reporting Compliance The Company files annual, quarterly and current reports, proxy statements and other information with the SEC. SEC filings are available to the public from commercial document retrieval services and at the Internet worldwide web site maintained by the SEC at www.sec.gov. Annaly’s website is www.annaly.com. The Company makes available on this website under “Investors - SEC Filings,” free of charge, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as well as proxy statement and other information filed with or furnished to the SEC as soon as reasonably practicable after such materials are electronically submitted to the SEC. Any stockholder intending to Pursuant to Any such nomination or proposal should be sent to Anthony C. Green, the Chief Corporate Officer, Chief Legal Officer and Secretary, Annaly Capital Management, Inc., 1211 Avenue of the Americas, New York, NY 10036 and, to the extent applicable, must include the information required by As of the date of this Questions and Answers When and where is the Annual Meeting? The Annual Meeting will be held on Other Information Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a paper copy of proxy materials? The SEC has approved “Notice and Access” rules relating to the delivery of proxy materials over the Internet. These rules permit the Company to furnish proxy materials, including this Proxy Statement and the Annual Report, to stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive paper copies of the proxy materials unless they request them. Instead, the Notice, which will be mailed to stockholders, provides instructions regarding how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may authorize your proxy via the Internet or by telephone. If you would like to receive a paper or email copy of the Company’s proxy materials, you should follow the instructions for requesting such materials printed on the Notice. Can I vote my shares by filling out and returning the Notice? No. The Notice identifies the items to be considered and voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to authorize your proxy via the Internet or by telephone or how to vote at the Annual Meeting or to request a paper proxy card, which will contain instructions for authorizing a proxy by the Internet, by telephone or by returning a signed paper proxy card. Who is entitled to vote at the Annual Meeting? Only common stockholders of record as of the close of business on the Record Date (March How can I vote my shares? You may vote online during the Annual Meeting prior to the closing of the polls at www.virtualshareholdermeeting.com/NLY2019, or by proxy via Internet (www.proxyvote.com), telephone (1-800-690-6903), or by completing and returning your proxy card. The Company recommends that you authorize a proxy to vote even if you plan to virtually attend the Annual Meeting as you can always change your vote online at the meeting. You can authorize a proxy to vote via the Internet or by telephone at any time prior to 11:59 p.m., Eastern Time, May 21, 2019, the day before the meeting date. What quorum is required for the Annual Meeting? A quorum will be present at the Annual Meeting if a majority of the votes entitled to be cast on any matter are present, in person or by proxy. share. Abstentions and What are the voting requirements that apply to the proposals discussed in this Proxy Statement? “Majority” means (a) with regard to an uncontested election of Directors, the affirmative vote of a majority of total votes cast for and against the election of each Director; (b) with regard to the advisory approval of executive compensation and the ratification of the appointment of Ernst & Young, a majority of the votes cast on the matter at the Annual Meeting; and (c) with regard to the proposed amendment to our charter, the affirmative vote of the holders of a majority of the total number of issued and outstanding shares of our common stock entitled to vote on the proposal. Other Information “Discretionary voting” occurs when a bank, broker, or other holder of record does not receive voting instructions from the beneficial owner and votes those shares in its discretion on any proposal as to which the rules of the NYSE permit such bank, broker, or other holder of record to vote (“routine matters”). When banks, brokers, and other holders of record are not permitted under the NYSE rules to vote the beneficial owner’s shares on a proposal (“non-routine matters”), if you do not provide voting instructions, your shares will not be voted on such proposal. This is referred to as a “broker non-vote.” For each of the proposals above, you can vote or authorize a proxy to vote “FOR,” “AGAINST” or “ABSTAIN.” What is the effect of abstentions and “broker non-votes” on the proposals submitted at the Annual Meeting? Abstentions “Broker non-votes,” if any, will have no effect on How will my shares be voted if I do not specify how they should be voted? Properly executed proxies that do not contain voting instructions will be voted as follows: (1) Proposal No. 1: (2) Proposal No. 2: (3) Proposal No. 3: (4) Proposal No. 4: FOR the ratification of the appointment of Ernst & Young LLP as The Company officers you You may revoke a proxy at any time before it is Other than the Who will count the vote? Representatives of Other Information All stockholders of record as of the Record Date can attend the Annual Meeting What is the pre-meeting forum and how can I access it? One of the benefits of the online Annual Meeting format is that it allows the Company to communicate more effectively with its stockholders via a pre-meeting forum that you After years of declining attendance by stockholders at Annaly’s in-person annual meetings and marked growth of our international stockholder base over the same time period, the Company moved to an online format for What if I have difficulties accessing the pre-meeting forum or locating my 16-digit control number prior to the day of the Annual Meeting Prior to the day of the Annual Meeting on May 22, 2019, if you need assistance with your 16-digit control number and you hold your shares in your own name, please call toll-free 1-866-232-3037 in the United States or 1-720-358-3640 if calling from outside the United States If you hold your shares in the name of a bank or brokerage firm, you will need to contact your bank or brokerage firm for assistance with your 16-digit control number. What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the live webcast of the Annual Meeting? If you encounter any difficulties accessing the live webcast of the Annual Meeting during the check-in or during the Annual Meeting itself, including any difficulties with your 16-digit control number, please call toll-free 1-855-449-0991 in the United States or 1-720-378-5962 if calling from outside the United States, for assistance. Technicians will be ready to assist you beginning at 8:30 a.m. Eastern Time with any difficulties. How will The expense of soliciting proxies will be borne by the Company. Proxies will be solicited principally through the use of mail, but Other Information The Company has retained Stockholders have the option to vote over the Internet or by telephone. Please be aware that if you vote over the Internet, you may incur costs such as telephone and access charges for which you will be responsible. What is “Householding” and does Annaly do this? “Householding” is a procedure approved by the SEC under which stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials receive only one copy of a company’s Could the Annual Meeting be postponed or adjourned? If a quorum is not present or represented, Who can help answer my questions? If you have any questions or need assistance voting your shares or if you need copies of this Annaly Capital Management, Inc. The Company’s principal executive offices are located at the address above. Endnotes Message from our Chairman, CEO and President (page i) Annaly at a Glance & Recent Operating Achievements (page 3) Annaly’s Diversified Shared Capital Model (page 4) Endnotes Annaly’s Diversified Shared Capital Model(cont’d)(page 4) Growth and Income (page 5) Delivering Significant Value for Stockholders (page 6) Stockholder Engagement (page 8) Corporate Responsibility & The Manager and the Management Agreement (page 9) Overview of the Manager’s 2018 Executive Compensation Program (page 10) Board Composition, Structure and Refreshment (page 11) Corporate Governance at Annaly (page 13) Endnotes The Board’s Role and Responsibilities (page 20) Board Effectiveness, Self-Evaluations and Refreshment (page 22) Management Agreement (page 25) Board Committees (page 28) Audit Committee & Compensation Committee (page 29) NCG Committee, Corporate Responsibility Committee & Risk Committee (page 30) Overview, Recent Changes & Management Agreement Terms (page 34) Endnotes Overview, Recent Changes & Management Agreement Terms(cont’d)(page 34) Structure and Amount of the Management Fee & Continued Cost Savings Related to the Externalization (page 35) Annual Review of Manager Performance and Management Fee Considerations (page 36) Summary of 2018 NEO Compensation (page 37) Compensation Discussion and Analysis (page 42) Stock Ownership Guidelines/Commitments (page 43) 2019 ANNUAL MEETING OF STOCKHOLDERS If you wish to view Annaly Capital Management, Inc.’s 2019 Annual Meeting of Stockholders webcast at the offices of Venable LLP (located at 750 E. Pratt Street, Suite 900, Baltimore, MD 21202), please complete the following information and return to Anthony C. Green, Chief Corporate Officer, Chief Legal Officer and Secretary, Annaly Capital Management, Inc., 1211 Avenue of the Americas, New York, NY 10036. Please note that no members of management or of the Board of Directors will be present at Venable LLP’s offices. In addition, you must bring a valid, government-issued photo identification, such as a driver’s license or a passport to Venable LLP’s offices. If the shares listed above are not registered in your name, please identify the name of the registered stockholder belowand include evidence that you beneficially own the shares. ANNALY CAPITAL MANAGEMENT, INC. VOTE BY INTERNET During The Meeting - Go towww.virtualshareholdermeeting.com/NLY2019 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 VOTE BY MAIL THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. ANNALY CAPITAL MANAGEMENT, INC. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Annaly Capital Management, Inc. Important Notice Regarding the Availability of Annaly Capital Management, Inc. Revoking all prior proxies, the undersigned hereby appoints Kevin G. Keyes and Anthony C. Green, and each of them, as proxies for the undersigned, with full power of substitution, to appear on behalf of the undersigned and to vote all shares of Common Stock, par value $.01 per share, of Annaly Capital Management, Inc. (the "Company") that the undersigned is entitled to vote at the Annual Meeting of Stockholders of the Company, which will be a virtual meeting conducted via live webcast to be held at 9:00 a.m., Eastern Time, on Wednesday, May 22, 2019 at www.virtualshareholdermeeting.com/NLY2019, and at any postponement or adjournment thereof as fully and effectively as the undersigned could do if personally present and voting, hereby approving, ratifying and confirming all that said attorneys and agents or their substitutes may lawfully do in place of the undersigned as indicated below. The shares represented by this proxy when properly executed, will be voted as directed.If no directions are given, this proxy will be voted in accordance with the Board of Directors' recommendations as listed on the reverse side of this card and at their discretion on any other matter that may properly come before the meeting. Address Changes/Comments: ANNALY CAPITAL MANAGEMENT, INC.(Name of Registrant as Specified In Its Charter)(Name of Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check the appropriate box)PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):[X]☑ No fee required. [ ]☐Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ [ ]Fee paid previously with preliminary materials.materials:☐ [ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Formform or Scheduleschedule and the date of its filing.1) Amount Previously Paid:previously paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4)Date Filed:4) Date Filed:

Notice of 2016Annual Meeting of Stockholdersand Proxy StatementMay 26, 2016, at 9:00 a.m.The Warwick Hotel65 West 54th StreetNew York, NY 10019

May 22, 2019 9:00 a.m. (Eastern Time) www.virtualshareholdermeeting.com/NLY2019 AmidstThe most important theme of 2018 was diversification. Annaly has transformed into a challenging macroeconomic environmentdiversified operating company built to capitalize on numerous strategic opportunities across multiple complementary businesses. Since our diversification strategy began in 2014, Annaly has broadly invested in over $10 billion of credit assets through continued development of our platform, expanded institutional partnerships and corporate acquisitions.(1)As a result, today each of our three credit businesses would rank among the top ten industry leaders in their respective industry sectors by size on a standalone basis.unprecedented volatility across all asset classes,86%, Annaly delivered strong financial results in 2015, declaring over $1.2has grown its market capitalization 64%, while delivering an additional $4.2 billion in cumulative dividends to shareholders.producing an attractive return on equity while maintaining a low leverage ratio relativePresident” in Endnotes section.Annaly Capital Management Inc. 2019 Proxy Statement i the industry.grow each of our four business platforms by expanding our internal investment options and continuing to broaden our proprietary partnerships. Today, Annaly has established over 20 strategic relationships with industry leading, dedicated partners across our four businesses, which have resulted in improved efficiencies and increased origination capabilities. In addition to our dividend program,organic growth, expansion of partnerships and superior capital markets access, Annaly remains well-positioned to continue to gain market share through further consolidation, as demonstrated by our acquisition of Hatteras Financial Corp. in August2016 and most recently of lastMTGE Investment Corp. in 2018.ii Annaly Capital Management Inc. 2019 Proxy Statement authorizedcollaborated once again with Capital Impact Partners, a repurchase plan of upnational mission-driven non-profit community development financial institution, to $1 billion oflaunch our common shares through December 31, 2016. As of March 31, 2016, we have cumulatively repurchased $614 million of stock under both our current programsecond social impact joint venture, which is specifically aimed at supporting affordable housing and our previous share repurchase program, which was initiatedother community development projects in 2012.Washington, D.C.Annaly delivered strong financial results in 2015, declaring over$1.2 billion in dividendsThroughout 2015, we continued to execute on our strategic plan to diversify our investments in assets with complementary cash flows. During the year, we expanded our allocation of capital into lower-levered, largely floating rate credit businesses from 11% to 23% of our total equity capital. We invested $1.3 billion in growing our commercial real estate business, launching our own residential credit platform and nearly tripling the size of our middle market lending portfolio. On a stand-alone basis of roughly $3 billion of equity capital, these three businesses would amount to one of the largest hybrid mortgage REITs in the world and three times the size of the average market capitalization for the 40 other mortgage REITs in the industry.As of March 31, 2016, we have cumulatively repurchased$614 million of stockthrough 2016we will continue our diversified and beyond, we remain focused both on returning valuecomplementary growth strategies and reward our shareholders by taking advantage of opportunities in the market that are unique to Annaly. We are more prepared than ever to benefit from our stockholderssize, liquidity, optionality and enhancing our corporate governance, compensation and management structures. The Board of Directors continually evaluates these structures to further alignoperational efficiency. I am grateful for the interestsconfidence of our Board, which has empowered us to be the industry leader we have become. I want to thank my fellow shareholders for their steadfast commitment, support and trust of this management with those of shareholders. Among numerous other initiatives, we announced the expansion of our stock ownership guidelines in the first quarter of 2016. Pursuantteam. And, to these guidelines, more than 40%each Annaly employee, I sincerely appreciate all of the Annaly team (includinghard work and dedication, every day. We have so much opportunity in front of us.executive officers)Annual Shareholder Meeting. The meeting will be asked to purchase predetermined amounts of shares in the open market. These guidelines reflect our desire to establish an ownership culture throughout the firm, which is also evidenced by the fact that senior management has purchased nearly 1.9 million common shares with an aggregate purchase price of $22.0 million since 2011.We expanded our allocation of capital into lower-levered, largely floating rate credit businesses from 11% to23%of our total equity capitalWe are proud of our attention and focus on our shareholders over the years – and our industry best practices are exemplified by what I believe is one of the most shareholder friendly management agreements in the asset management industry. Our management contract is structured without termination or incentive fees, has one of the lowest fixed management fee percentages in the industry and a two-year term that provides our Board and shareholders with the opportunity to actively monitor and assess our performance over reasonable time frames. In addition to the stock ownership guidelines discussed above, other recent enhancements include the adoption of a robust clawback policyconducted online via live webcast for the management fee, increased stock ownership guidelines forsecond consecutive year and we look forward to engaging with you then.

Kevin Keyes

Chairman, Chief Executive Officer & President

April [___], 2019Senior management has purchased nearly1.9 million common shares since 2011www.annalyannualmeeting.com IAnnaly Capital Management Inc. 2019 Proxy Statementiii Independent Directors, a four-year stock holding period requirement, an anti-pledging policy (which is complementary to our existing anti-hedging policy) and the creation of the role of Lead Independent Director, which is currently held by Jon Green.Also, given the various changes to the market, our industry and our business, we have dedicated tremendous focus and resources to enhancing our financial disclosure and risk management practices. Over the past year, we provided increased transparency into our amended capital allocation policy and more granular portfolio detail on our growing credit businesses. This year’s proxy statement, which includes an updated format and graphics, also reflects our continued focus on accuracy and transparency. Our paramount responsibility, as long term stewards of capital, is to ensure that we have appropriate clarity within our financial statements, strong risk management practices and the comprehensive operational infrastructure needed to support our evolving businesses. In 2015, significant achievements were made within our operating strategies including: attracting numerous key hires into our risk, legal, accounting, human resources and information technology teams; implementing enhanced asset, portfolio and risk management systems, including a comprehensive risk rating system across the various investment businesses; and restructuring our internal management reporting lines and governance committees to more appropriately monitor and manage our evolving strategies.I look forward to welcoming many of you to our 2016 Annual Meeting of Stockholders.Sincerely,

Kevin G. KeyesChief Executive Officer and PresidentApril 12, 2016Creation of the role ofLead Independent DirectorEnhancing our financial disclosure and risk management practicesScaling our operating platform to support growth anddiversification of our portfolioIIAnnaly Capital Management, Inc.► 2016 Proxy Statement

>Notice of Annual Meeting of StockholdersTo Be Held May 26, 2016at 9:00 a.m. (Eastern Time)The Warwick Hotel, 65 West 54th Street,New York, NY 10019WeAnnaly Capital Management, Inc., a Maryland corporation (“Annaly” or the “Company”), will hold theits annual meeting of the stockholders of Annaly(the “Annual Meeting”) on May 26, 2016,22, 2019, at 9:00 a.m. (Eastern Time) online at the Warwick Hotel, 65 West 54th Street, New York, NY 10019, to:www.virtualshareholdermeeting.com/NLY2019, to consider and vote upon:►1.►2.►3.4. Ratify the appointment of Ernst & Young LLP as ourthe Company’s independent registered public accounting firm for 2016the year ending December 31, 2019..WeThe Company will also transact any other business as may properly come before our annual meetingthe Annual Meeting or any adjournmentpostponement or postponementadjournment thereof. Only our common stockholders of record at the close of business on March 29, 2016,25, 2019, the record date for the annual meeting,Annual Meeting, may vote at the annual meetingAnnual Meeting and any adjournmentspostponements or postponementsadjournments thereof.To view the Proxy Statement and other materials about the annual meeting, go to www.annalyannualmeeting.com.If you attend the annual meeting in person, you will need to present proof of your ownership of our common stock as of the record date, and valid government-issued photo identification.By Order of theThe Company’s Board of Directors